What 7 companies did AT&T split into?

Understanding the complex history of AT&T's corporate evolution is key to grasping its present structure. This post directly answers "What 7 companies did AT&T split into?" by detailing the landmark divestitures and their lasting impact on the telecommunications landscape.

The Genesis of the Split: A Historical Overview

The story of AT&T's fragmentation is not merely a tale of corporate restructuring; it's a pivotal chapter in the history of American innovation and regulation. For decades, American Telephone and Telegraph Company (AT&T) operated as a monolithic entity, a regulated monopoly that controlled virtually every aspect of the nation's telephone service. This included manufacturing equipment, providing local and long-distance services, and conducting research. While this structure fostered incredible advancements, such as the invention of the transistor and the development of early computer networking, it also led to concerns about market dominance, stifled competition, and potentially inefficient operations. The seeds of divestiture were sown by a growing consensus among regulators and policymakers that a more competitive market would ultimately benefit consumers and drive further technological progress. The antitrust lawsuit filed by the U.S. Department of Justice in 1974 was the catalyst, setting in motion a legal and regulatory process that would fundamentally reshape the telecommunications industry.

The Landmark Breakup of 1984

The year 1984 stands as a watershed moment in the annals of American business. On January 1, 1984, AT&T, once a symbol of American industrial might, was legally compelled to divest its local operating companies. This monumental event, often referred to as the "breakup of AT&T" or the "divestiture," was the culmination of a lengthy antitrust battle. The core of the agreement was to separate AT&T's manufacturing and long-distance businesses from its local telephone networks. The rationale behind this drastic measure was to foster competition in the burgeoning telecommunications market, particularly in long-distance services and equipment manufacturing, while ensuring that local telephone service remained universally accessible and affordable. The breakup was designed to create a more dynamic and innovative industry, moving away from the rigidities of a regulated monopoly. This strategic unbundling aimed to unlock the potential for new services and technologies that had been constrained by the vertically integrated structure of the old AT&T. The immediate aftermath saw the creation of a new, leaner AT&T focused on long-distance and manufacturing, and seven independent regional holding companies that would manage the local telephone infrastructure.

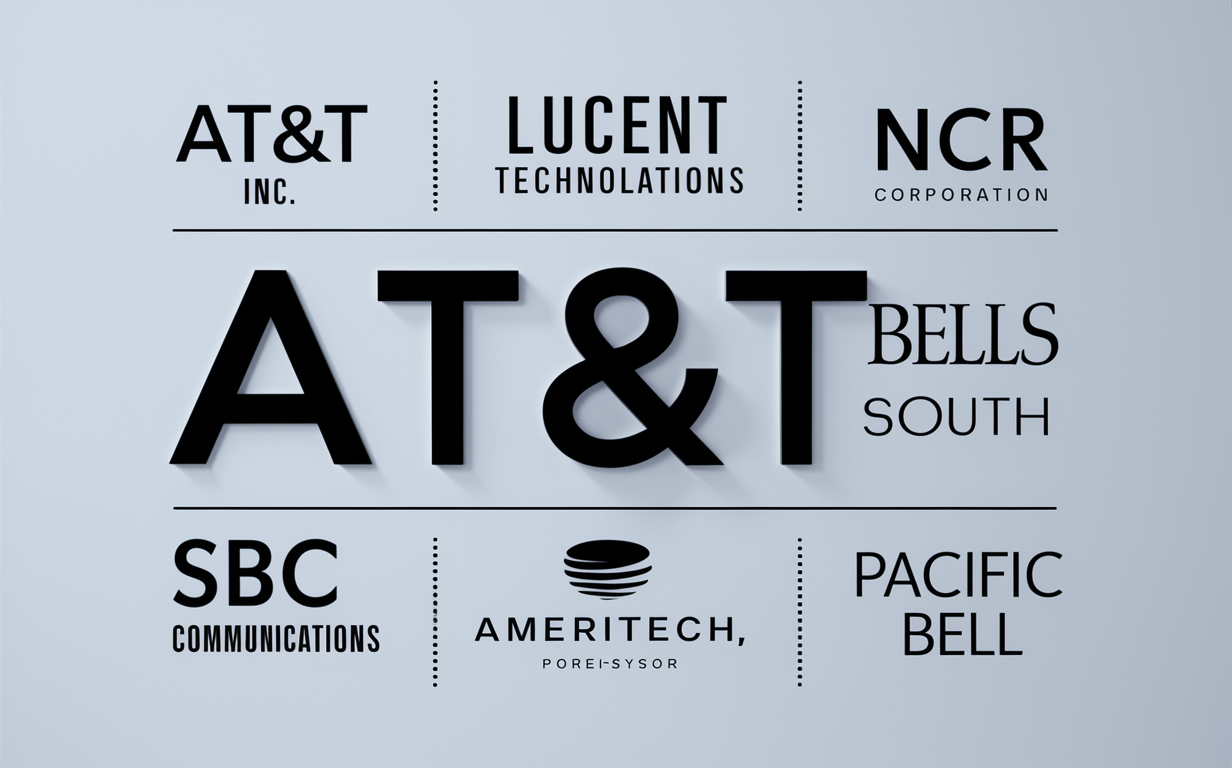

Introducing the Seven "Baby Bells"

The most visible and significant outcome of the 1984 AT&T divestiture was the creation of seven independent regional holding companies, colloquially known as the "Baby Bells." These entities inherited the local telephone networks that had previously been part of AT&T's Bell System. Each Baby Bell was granted a specific geographic territory within which it held a monopoly over local telephone service. This division was strategic, aiming to create companies of roughly equal size and market value, thereby preventing any single entity from wielding undue influence. The creation of these seven companies was intended to be a transitional phase, with the expectation that they would eventually operate in a more competitive environment. Their initial mandate was to maintain and upgrade the local loop, providing reliable dial tone and basic telephone services to millions of Americans. However, the divestiture also opened the door for these regional monopolies to eventually expand into new markets, including long-distance services, cellular communications, and eventually, the internet and cable television. The regulatory framework surrounding these Baby Bells was complex, initially restricting their activities to prevent them from leveraging their local monopoly power into other areas, but these restrictions would gradually erode over time, paving the way for the consolidation that would define the industry in the decades to come.

The Original Seven Companies: A Detailed Look

The seven regional Bell Operating Companies (BOCs) that emerged from the 1984 AT&T breakup were distinct entities, each serving a specific geographic region of the United States. Understanding these original seven is crucial to tracing the lineage of today's telecommunications giants. They were established as independent, publicly traded corporations, with AT&T retaining its long-distance business and its manufacturing arm, Western Electric (which was renamed AT&T Technologies). The seven Baby Bells were:

1. Ameritech Corporation

Serving the Midwest, Ameritech's territory included Illinois, Indiana, Michigan, Ohio, and Wisconsin. It was one of the larger of the Baby Bells and would later become a significant player in the convergence of telecommunications and information services. Its focus was on modernizing the network infrastructure in its densely populated and industrially significant region.

2. Bell Atlantic Corporation

Bell Atlantic covered a large swath of the Eastern United States, encompassing Delaware, Maryland, New Jersey, Pennsylvania, and West Virginia, as well as the District of Columbia. This region included major metropolitan areas and a diverse economic base, providing fertile ground for growth and innovation in telecommunications.

3. BellSouth Corporation

BellSouth's operational footprint was in the Southeastern United States, including Alabama, Florida, Georgia, Kentucky, Mississippi, North Carolina, South Carolina, and Tennessee. This region was experiencing significant population growth, presenting both opportunities and challenges for the company in expanding its network capabilities.

4. NYNEX Corporation

NYNEX (New York Information Telephone Exchange) served the Northeastern United States, primarily New York and New England (Maine, Massachusetts, New Hampshire, Rhode Island, and Vermont). Its territory included some of the most densely populated and economically vital areas of the country, demanding advanced infrastructure.

5. Pacific Telesis Group

Pacific Telesis operated on the West Coast, covering California and Nevada. This region was at the forefront of technological innovation, particularly in Silicon Valley, and Pacific Telesis played a crucial role in supporting the burgeoning tech industry with its network services.

6. Southwestern Bell Corporation (later SBC Communications)

Southwestern Bell served a large area in the central and southern United States, including Arkansas, Kansas, Missouri, Oklahoma, and Texas. This vast territory presented unique challenges in terms of network deployment and maintenance, but also offered significant growth potential.

7. US West, Inc.

US West covered a vast, sparsely populated region in the Western United States, including Arizona, Colorado, Idaho, Iowa, Minnesota, Montana, Nebraska, New Mexico, North Dakota, Oregon, South Dakota, Utah, Washington, and Wyoming. Its challenge was to provide modern telecommunications services across a geographically diverse and often challenging terrain.

These seven companies, while initially independent, were bound by their common heritage and the regulatory environment. Their subsequent journeys through mergers, acquisitions, and strategic realignments would eventually lead to the consolidation of the industry and the re-emergence of a new AT&T, albeit a very different entity from its predecessor.

Post-Breakup Evolution and Mergers

The divestiture of 1984 was not an endpoint but rather a beginning. The newly formed Baby Bells, initially confined to their regional monopolies, quickly began to explore avenues for growth and diversification. The regulatory landscape, which had initially imposed strict limitations on their activities, gradually began to loosen. This allowed the Baby Bells to venture into new business areas, including long-distance services, cellular telephony, and eventually, data services and the internet. The late 1990s and early 2000s witnessed a period of intense consolidation in the telecommunications industry, driven by the desire to achieve economies of scale, expand market reach, and offer bundled services. The Baby Bells, once fierce competitors in their own right, began to merge with each other, driven by strategic imperatives and the opportunities presented by technological advancements. This consolidation was also fueled by the Telecommunications Act of 1996, which aimed to deregulate the industry and promote competition, ironically leading to a wave of mergers that created larger, more dominant players. The goal of fostering competition had, in some ways, led to a new set of regional giants, each seeking to become a national or even global force.

The Rise of the "Baby Bells"

Following the 1984 breakup, the seven regional Bell Operating Companies embarked on a journey of expansion and transformation. Initially focused on their core business of providing local telephone service, they soon realized the limitations of operating within strictly defined geographic territories. The advent of new technologies like cellular phones and the increasing demand for data services presented significant opportunities. Regulatory changes, particularly the Telecommunications Act of 1996, played a crucial role in dismantling the barriers that had previously confined the Baby Bells. This legislation allowed them to enter each other's markets and offer long-distance services, a move that had been strictly prohibited for decades. The Baby Bells began to invest heavily in upgrading their infrastructure, laying the groundwork for the digital age. They expanded into wireless communications, becoming major players in the burgeoning mobile market. This period was characterized by aggressive investment, strategic acquisitions, and a relentless pursuit of market share. The Baby Bells were no longer just local phone companies; they were evolving into diversified telecommunications conglomerates, laying the foundation for the integrated service providers of the 21st century. Their ability to leverage their existing customer base and network infrastructure provided them with a significant competitive advantage as they expanded into new and emerging markets.

Key Mergers and Acquisitions Shaping the Landscape

The post-breakup era was defined by a series of significant mergers and acquisitions that reshaped the telecommunications landscape. The original seven Baby Bells, driven by ambition and the changing market dynamics, began to consolidate. Here are some of the most pivotal mergers that illustrate this trend:

1. SBC Communications Acquires Pacific Telesis Group (1997)

This was one of the first major consolidations among the Baby Bells. SBC, which had already expanded beyond its original Southwestern Bell territory, acquired Pacific Telesis, significantly expanding its presence on the West Coast. This merger created a powerful entity with a vast service area.

2. Bell Atlantic Acquires NYNEX Corporation (1997)

In a move that created a telecommunications behemoth in the Northeast, Bell Atlantic merged with NYNEX. This combination brought together two of the most populous and economically vital regions of the country under a single corporate umbrella, significantly increasing their market power and service reach.

3. SBC Communications Acquires Ameritech Corporation (1999)

Following its acquisition of Pacific Telesis, SBC continued its aggressive expansion by acquiring Ameritech. This merger created the largest local telephone company in the United States at the time, stretching across a massive portion of the country and solidifying SBC's position as a dominant national player.

4. Verizon Communications is Formed (2000)

The merger of Bell Atlantic and GTE (General Telephone & Electronics, a non-Bell company) created Verizon Communications. This was a landmark event, as it brought together a major Baby Bell with one of the largest independent telephone companies, creating a formidable competitor to the evolving AT&T and SBC. Bell Atlantic's earlier acquisition of NYNEX meant that Verizon effectively inherited the assets of three significant entities.

5. Cingular Wireless (later AT&T Mobility) Emerges

Several Baby Bells, including BellSouth and SBC, were also major players in the wireless space. They participated in the formation of Cingular Wireless, a joint venture that eventually became one of the largest mobile carriers in the U.S. This move was critical as wireless communication began to overtake traditional landline services.

6. Qwest Communications Acquires US West (2000)

Qwest, a newer telecommunications company that had grown through acquisitions, purchased US West. This merger consolidated a vast territory in the Western United States, though Qwest faced significant financial challenges in the years that followed.

These mergers were not just about expanding geographic reach; they were also about consolidating resources, achieving economies of scale, and preparing for the competitive battles of the digital age. The landscape that had been fractured into seven pieces in 1984 was rapidly coalescing into a few dominant players.

AT&T's Re-emergence and Further Transformations

The original AT&T, which retained its long-distance and manufacturing operations after the 1984 breakup, also underwent significant transformations. It faced intense competition in the long-distance market from companies like MCI and Sprint. To regain its footing and adapt to the evolving technological landscape, AT&T pursued a strategy of diversification and acquisition. A pivotal moment in this transformation was the acquisition of TCI (Tele-Communications Inc.) in 1999, a move that signaled AT&T's ambition to enter the cable television and broadband internet market. This was followed by the acquisition of AT&T Wireless in 2005, which allowed AT&T to re-establish a significant presence in the mobile communications sector. However, the most defining moment for the AT&T brand came in 2005 when SBC Communications acquired the original AT&T. SBC then adopted the iconic AT&T name and branding, effectively marking the re-emergence of AT&T as a major integrated telecommunications provider. This acquisition brought together the vast local network infrastructure of SBC with the long-distance, wireless, and broadband assets of the former AT&T. In the years that followed, this new AT&T continued to expand its reach and services, acquiring companies like BellSouth (2007), further consolidating its position. The company then made a bold move into content by acquiring Time Warner in 2018, signaling a shift towards becoming a media and entertainment powerhouse alongside its core telecommunications business. These strategic moves demonstrate the dynamic nature of the industry and AT&T's continuous efforts to adapt and redefine itself in response to technological shifts and market demands.

Legacy and Impact in 2025

The reverberations of the 1984 AT&T breakup continue to shape the telecommunications industry in profound ways, even as we approach 2025. The original seven companies, through a complex series of mergers, acquisitions, and strategic realignments, have largely coalesced into a few dominant players. The spirit of competition that the breakup aimed to foster has manifested in a dynamic market, albeit one characterized by significant consolidation. The legacy of the Baby Bells is evident in the infrastructure that underpins modern communication networks, from fiber optic cables to wireless towers. The divestiture forced a re-evaluation of how essential services are delivered and regulated, paving the way for greater innovation and consumer choice. The ongoing evolution of technologies like 5G, artificial intelligence in network management, and the expansion of satellite internet services are all built upon the foundations laid by these historical transformations. The industry's trajectory, from a regulated monopoly to a fiercely competitive, albeit consolidated, landscape, offers valuable lessons for other sectors grappling with technological disruption and market evolution. The drive for innovation, the constant pursuit of efficiency, and the relentless focus on customer experience are all enduring legacies of the AT&T breakup.

Current Telecom Giants and Their Roots

As of 2025, the telecommunications landscape is dominated by a few massive corporations, each with a direct lineage tracing back to the original AT&T breakup. The seven "Baby Bells" no longer exist as independent entities; instead, they have been absorbed or merged into larger conglomerates. Understanding these current giants requires looking at their historical roots:

1. AT&T Inc.

The current AT&T is a direct descendant of the 1984 breakup, though its form is drastically different. It was largely reconstituted through the acquisition of the original AT&T by SBC Communications in 2005. SBC itself was a product of the breakup, having started as Southwestern Bell. Through subsequent acquisitions of BellSouth and AT&T Wireless, the modern AT&T has become a comprehensive provider of mobile, broadband, enterprise, and increasingly, media and content services. Its roots are intertwined with Southwestern Bell, Pacific Telesis, Ameritech, and the original AT&T long-distance and wireless operations.

2. Verizon Communications Inc.

Verizon is another titan of the industry, formed from the merger of Bell Atlantic and GTE in 2000. Bell Atlantic was one of the original Baby Bells. Through this merger, Verizon inherited the vast network infrastructure and customer base of both entities, becoming a dominant force in both landline and wireless communications. Its lineage includes Bell Atlantic, NYNEX, and GTE.

3. Lumen Technologies (formerly CenturyLink)

While not a direct Baby Bell, Lumen Technologies has grown significantly through acquisitions of former regional telephone companies. Its acquisition of Level 3 Communications significantly bolstered its enterprise and wholesale network capabilities. While it doesn't trace directly to one of the original seven in the same way as AT&T or Verizon, its operations are built upon the legacy infrastructure that was once part of the Bell System and other independent carriers.

4. T-Mobile US

T-Mobile has grown significantly through organic growth and strategic acquisitions, most notably its merger with Sprint in 2020. While Sprint was a competitor to AT&T and Verizon, T-Mobile's mobile network is a key part of the modern telecom ecosystem. Its competitive pressures have often driven innovation and pricing strategies across the industry.

The consolidation has led to a market where these few large players offer a wide array of services, from mobile and home internet to business solutions and entertainment. The competitive landscape, while less fragmented than in the immediate post-breakup era, remains dynamic, with ongoing investments in new technologies like 5G and fiber optics driving future growth and competition.

Lessons Learned for the Modern Telecommunications Industry

The history of AT&T's breakup and the subsequent evolution of the telecommunications industry offers several enduring lessons for businesses and regulators in 2025 and beyond:

- The Double-Edged Sword of Consolidation: While mergers and acquisitions can lead to economies of scale, operational efficiencies, and expanded service offerings, they also carry the risk of reduced competition, higher prices, and stifled innovation if not carefully managed. Regulators must strike a balance between facilitating growth and protecting consumer interests.

- Adaptability is Key: The telecommunications industry is in a constant state of flux due to rapid technological advancements. Companies that fail to adapt, invest in new technologies, and diversify their service portfolios are at risk of obsolescence. The transition from landlines to mobile, and now towards 5G and beyond, highlights this imperative.

- The Importance of Infrastructure: Reliable and robust infrastructure remains the backbone of the digital economy. Investments in fiber optics, 5G networks, and cloud computing are crucial for economic growth and societal connectivity. The legacy infrastructure built by the Baby Bells, though modernized, still plays a vital role.

- Regulation's Evolving Role: The regulatory environment has shifted dramatically since 1984. From strict oversight of a monopoly to deregulation and then to a more nuanced approach that addresses market concentration and net neutrality, regulators continue to grapple with how best to foster a competitive and innovative market.

- Convergence of Industries: The lines between telecommunications, media, and technology are increasingly blurred. Companies like AT&T's foray into content demonstrate this trend. Future success will likely depend on a company's ability to integrate services across these domains and create synergistic offerings.

- Consumer Choice and Access: While competition can drive down prices, ensuring universal access to essential services, particularly in rural or underserved areas, remains a critical challenge. Public-private partnerships and targeted investments are often necessary to bridge the digital divide.

These lessons underscore the complexity of managing a vital, rapidly evolving industry. The decisions made decades ago continue to influence the competitive dynamics and technological trajectory of telecommunications today.

Conclusion: A Network Reimagined

The question "What 7 companies did AT&T split into?" leads us on a fascinating journey through the history of American telecommunications. The landmark 1984 divestiture fractured the monolithic AT&T into seven regional Bell Operating Companies, the iconic "Baby Bells." These were Ameritech, Bell Atlantic, BellSouth, NYNEX, Pacific Telesis, Southwestern Bell, and US West. While these seven entities represented the immediate outcome, their story is far from over. The subsequent decades witnessed an unprecedented wave of consolidation, driven by technological advancements and strategic mergers. These Baby Bells, once confined to their territories, evolved, acquired, and merged, gradually reforming into the giants we know today. The current telecommunications landscape, dominated by entities like AT&T Inc. and Verizon Communications, bears the indelible mark of this historical fragmentation and subsequent reintegration. The legacy of the breakup is not just in the corporate structures but in the competitive spirit it ignited and the infrastructure that continues to evolve. Understanding this complex lineage is crucial for appreciating the forces that shape our connected world in 2025, demonstrating that the network has indeed been reimagined, piece by piece, into the powerful, interconnected system it is today.